Santhosh Kumar, Vice Chairman – ANAROCK Property Consultants

Real estate is a dynamic industry where things can change from year to year and even from quarter to quarter. The Indian real estate market has certainly been in flux after the recent policy upheavals. As such, investment decisions must necessarily move with the times.

Here are 2018’s top-ranking real estate investment hotspots in West and North India.

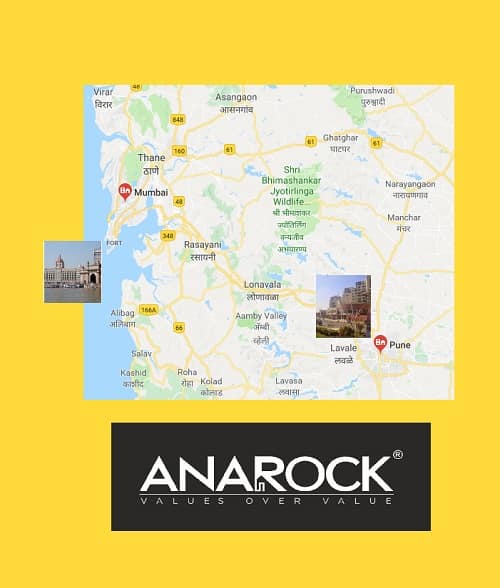

West India

Beyond a doubt, the Mumbai Metropolitan Region (MMR) and Pune have remained West India’s most favourable cities for real estate investment in 2018. The MMR realty market has regained a lot of momentum over the last few quarters, with both sales and new supply increasing q-o-q.

MMR: As per ANAROCK data, out of the total new supply of approximately 50,100 units across the top 7 cities (NCR, MMR, Chennai, Bengaluru, Pune, Kolkata and Hyderabad) in Q2 2018, MMR saw maximum new launches with nearly 13,600 new units entering the market. There was a 59% increase in this new supply as against Q1 2018. On the sales front too, MMR clocked the maximum housing sales as against the other cities, with approximately 15,200 units being sold in Q2 2018 – an increase of nearly 26% as against the previous quarter.

Pune: Meanwhile, the new housing supply in Pune took a quantum leap of 214% in Q2 2018. This quarter saw the launch of approximately 6,900 new units as against 2,200 units in Q1 2018. The new supply was dominated by two large projects in the affordable category. In terms of housing sales, the city witnessed a 24% increase in Q2 2018 over the preceding quarter.

The realty markets in both these regions are very upbeat in 2018. Interestingly, the maximum launches in both these cities were in the affordable segment (<Rs 40 lakh) – evidently influenced by the various Government policy reforms and schemes specifically geared to boost affordable housing supply and consumption over the last few quarters.

North India

In North India, the major realty hotspots in 2018 are Gurgaon in Haryana, and Noida and Greater Noida in Uttar Pradesh.

- Gurgaon saw the launch of nearly 1,150 units in Q2 2018

- Noida and Greater Noida together saw the addition of approximately 4,500 units.

The new housing supply in both these regions saw a drop in Q2 2018 over the previous quarter – however, the sales numbers are buoyant. While Gurgaon saw a 20% q-o-q risein housing sales, Noida and Greater Noida collectively saw a 25% increase in Q2 2018.

Top Investment Destinations – affordable and the high-end

If we examine the most lucrative micro-markets in West and North India currently, it emerges that the top high-end destinations are not necessarily the central districts of the city/region. This is because most central locations are saturated and have minimal or no new supply – in other words, reduced growth potential. For this reason, locations that offer multiple prime property options have been considered:

Precautions for Affordable Housing Investors

While the top affordable micro markets offer ample options for investors and end-users, they also call for the highest-possible due diligence – over and above RERA registration. The due diligence must include:

- The builder’s past track record for project completion and consistent product quality (stick to reputed builders – the new regulatory environment is separating the wheat from the chaff, but it will take time to do a complete job of it).

- Civic infrastructure, particularly public transport facilities, water availability and sanitation (most affordable destinations are emerging micro markets – read work-in-progress. Assurances of the imminent arrival of civic infrastructure must be verified against public announcements by the concerned authorities, or through credible real estate consultancies).

- Availability of social infrastructure in and around every project under consideration (being on a budget should not mean that residents have to do without the basic necessities of life, including shopping, healthcare and entertainment)

Precautions for High-end Housing Investors

The premium housing market has had a lot of issues in the recent past, but lack of supply is not one of them. Against the constant white noise of the hectic promotion of these projects, finding the perfect investment property amounts often presents the proverbial needle-in-the-haystack conundrum.

- An investor in high-end housing must have a clear idea of what constitutes ‘premium’ for his potential buyers. The most marketable premium facilities are the ones they can and will actually use. For instance, not every premium home buyer is interested in an Olympic-sized swimming pool, a skating rink or a tennis court. However, high-end security at both the project and unit level, reserved multiple car parking and location advantages in terms of superior connectivity to schools, office hubs and the airport and railway station will always score high.

- Go Pro: While it is always advisable to use the services of a credible property consultancy regardless of budget bandwidth, this factor becomes even more important in high-end housing. Besides easing the search process, professional guidance can also ensure better ROI in the long run.

Top Property Hotspots 2018 – West and North India