Mumbai, 17th November, 2021: Mswipe, leading end-to-end digital enabler of SMEs, today said that it has partnered with OneCard, India’s first exclusive mobile-first credit card to offer no cost Equated Monthly Instalments (EMI) , across its 2.50 lakh strong retailer network.

The partnership will enable users of OneCard to seamlessly access no or low interest EMIs’ while availing mid and high-value purchases at retail outlets powered by Mswipe terminals.

The collaboration is expected to bolster consumer sentiments in a big way as customers can now seamlessly convert their purchase transactions into easy, no-interest monthly instalments.

With this partnership, Mswipe will power its partner brands to increase sales through attractive checkout offers to their customers, while also targeting the tech-savvy customers of OneCard. Mswipe is working with brand partners in designing value offers for customers. On the other hand, OneCard will offer its card users to seamlessly avail no interest or low interest EMIs at checkout.

Mswipe CEO Ketan Patel said, “Pay Later offerings delight shoppers and are a major consideration during purchase. It also improves the checkout process significantly by reducing the time taken to complete the purchase. Our solution helps brand partners to increase sales and retailers to add more revenue. We are happy to extend our ecosystem to OneCard customers.”

OneCard Co-founder and CMO Vibhav Hathi said “At OneCard, besides offering flexibility and visibility on spends, we offer our customer full control of every aspect involved in credit and payments. Our partnership with Mswipe will help us leverage their reach and technology expertise to provide our users a seamless & superior EMI experience. With this partnership our customers will now be able to enjoy hassle-free shopping while availing easy and affordable EMIs at check-out.”

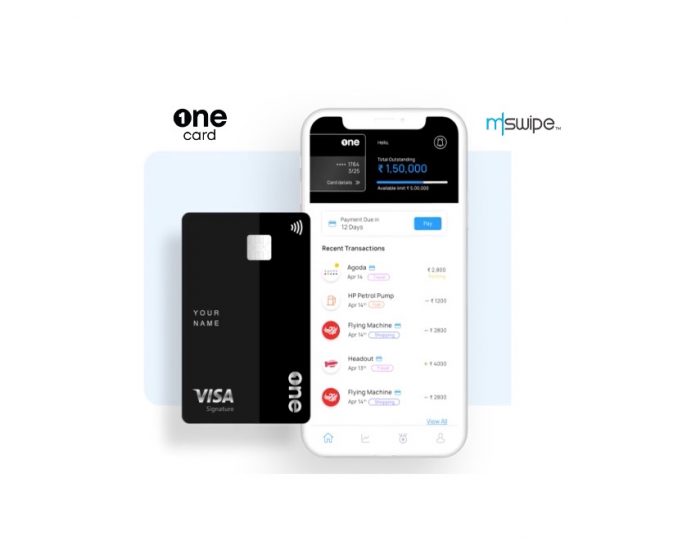

OneCard aims to digitally revolutionize credit and payments in India. The card allows its users to control all aspects of OneCard from an app. This includes enabling offline and online transactions, enabling domestic and international transactions, paying the bill and locking the card. The OneCard app gives card holders a completely transparent view of their credit card spends, rewards, EMI, limits, payments, etc. FPL Technologies earlier launched OneScore in 2019, to empower people looking to monitor and manage their credit health in a simple and secure manner. The scoring platform is widely popular and has acquired more than 8million users within just two years of its launch.

About Mswipe

Mswipe aims to be India’s largest financial services platform for SMEs by providing seamless, omni-channel digital payments and other value-added financial services. It is the largest independent mobile POS merchant acquirer and network provider with 6.75 lakh POS and 11 lakh QR merchants across the country. Mswipe offers a host of payment acceptance services for SME’s enabling them to accept – cards, wallets, mobile payment apps and bank apps, contactless and QR payments. Headquartered in Mumbai, Mswipe began operations in 2011. Its key investors include B Capital, UC-RNT, Falcon Edge Capital, Matrix Capital Partners, DSG Partners and Epiq Capital.

About OneCard

OneCard is a mobile-first credit card created by FPL Technologies. FPL Technologies was founded by Anurag Sinha, Rupesh Kumar, and Vibhav Hathi, who come from banking backgrounds with deep expertise in payments, credit and building and scaling digital businesses. FPL is on a mission to re-imagine credit and payments from first principles; OneCard can be downloaded from www.getonecard.app

Mswipe partners with OneCard to offer EMI at POS