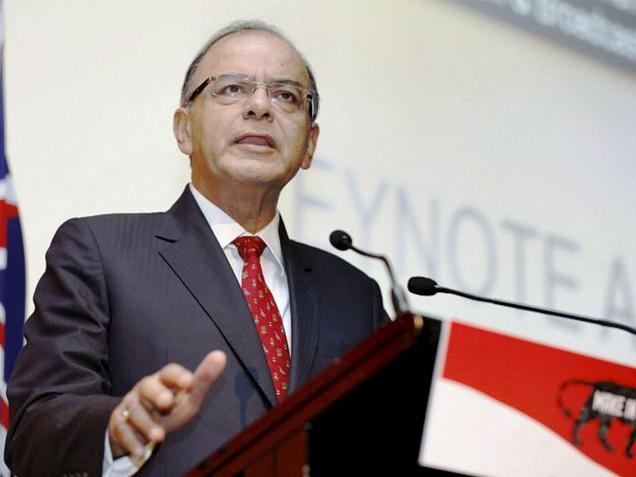

In an indication that the government may attempt to lower income tax rates or revise slabs to raise tax exemption limits in next year’s Budget, Finance Minister Arun Jaitley on Saturday said that tax rates in the country are going to be reasonable, and efforts will be made to enhance the tax base.

“Our tax rate will be reasonable, base has to be much larger and the tax department has to start trusting the assessee and the taxpayer,” Jaitley said at an event jointly organised by the Institute of Chartered Accountants of India (ICAI), and the Finance and Commerce Ministries.

Jaitley’s comment comes a few weeks ahead of the Finance Ministry plunging into the mammoth Budget-making exercise for 2017-18. The ministry has advanced the exercise to August from the earlier practice of commencing Budget making from September-October.

Jaitley’s comment also comes close on the heels of Prime Minister Narendra Modi exorting tax authorities to double the tax base to 10 crore people from the existing little over 5 crore.

India currently has three slabs and corresponding rates of incomes tax — 10% on income exceeding Rs 2,50,000, 20% on income exceeding Rs 5,00,000, and 30% on income exceeding Rs 10,00,000.

For a 125-crore people, India has only about 4 crore taxpayers. Economists are of the opinion that high rates of income taxe makes the base of tax payers narrow. To enhance the taxpayer base, the government has already started awareness campaigns on how taxes help in nation-building and providing social benefits to the poor and needy. But, to give the true meaning to the prime minister’s dream of almost doubling the tax base, the government needs to do more than just the campaigns, feel economists and analysts.

Jaitley himself is in favour of keeping income tax rates lower in order to give more money in the hands of people whose savings can eventually be routed to infrastructure creation.

India’s tax rates will be reasonable, says Jaitley