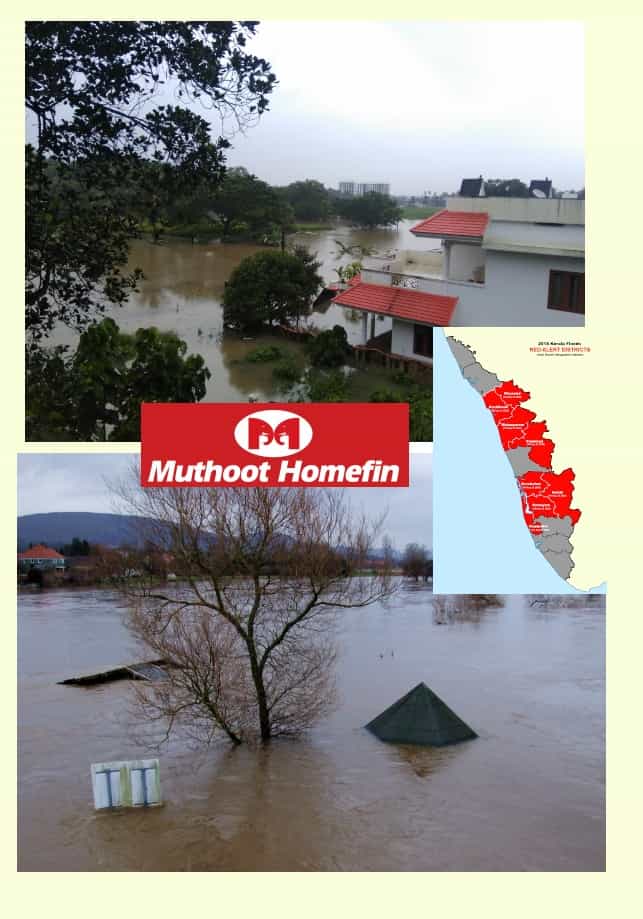

September 3rd, 2018, Kochi/Team Estrade//– Muthoot HomeFin a subsidiary of Muthoot Finance announces Punarnirman Kerala – Home improvement Loans post the crisis from the biggest floods Kerala has ever witnessed.

In this scheme, the company will offer special loans for the renovation / reconstruction of houses in the flood affected areas. The loans will be processed with easy documentation and for longer tenure.

Mr. George Alexander Muthoot, Managing Director, Muthoot Finance said, “In an earnest attempt to provide a helping hand in the rehabilitation of people and rebuilding the State, Muthoot Finance has announced a special Home Improvement Scheme which will help Keralites to recover from the recent floods that devasted the State and its economy.”

He further added, “People who have properties located in the State of Kerala even if they are not living in the State are eligible for this scheme. The Loan will help the reconstruction/ renovation of the damaged homes. The amount of the Loan ranges from Rs1 Lac to maximum Rs. 10 Lac.”

The scheme is valid till December, 31, 2018. The maximum loan term shall be for a period of 20 years. PMAY subsidy is also available for eligible cases (subject to terms & conditions).

Please visit your nearest Muthoot Finance branch for further details or can call – 0484 6690511 – 518.

About Muthoot Homefin (India) Limited-( MHIL)

MHIL is a Housing Finance Company registered with The National Housing Bank (NHB). It is a wholly owned subsidiary of Muthoot Finance Limited.

MHIL’s prime goal is to contribute towards financial inclusion of LMI families by opening doors of formal housing finance to them. Its focus is on extending Affordable Housing Finance. MHIL would be concentrating primarily on retail housing loans in the initial stages. It operates on a ‘Hub and Spoke’ model, with the centralised processing based out of Corporate Office at Mumbai. MHIL has operations in 11 states – Maharashtra (including Mumbai), Gujarat, Rajasthan, Madhya Pradesh, Kerala, Karnataka, Telangana, Andhra Pradesh, Haryana, Punjab and Uttar Pradesh.

MHIL has long term debt rating of AA- (Stable) for its bank limits which indicates “High degree of safety with regard to timely servicing of financial obligations and carry very low credit risk” and short term debt rating of ‘A1+’ for its Commercial Paper programme which indicates “Very strong degree of safety regarding timely payment of financial obligations and carry lowest credit risk” from ICRA Ltd.

CRISIL Ltd assigned long term debt rating of AA- (Stable) for its bank limits which indicates “High degree of safety with regard to timely servicing of financial obligations and carry very low credit risk.”

Muthoot Home Fin announces ‘Punarnirman Kerala’