Mumbai, Maharashtra, India

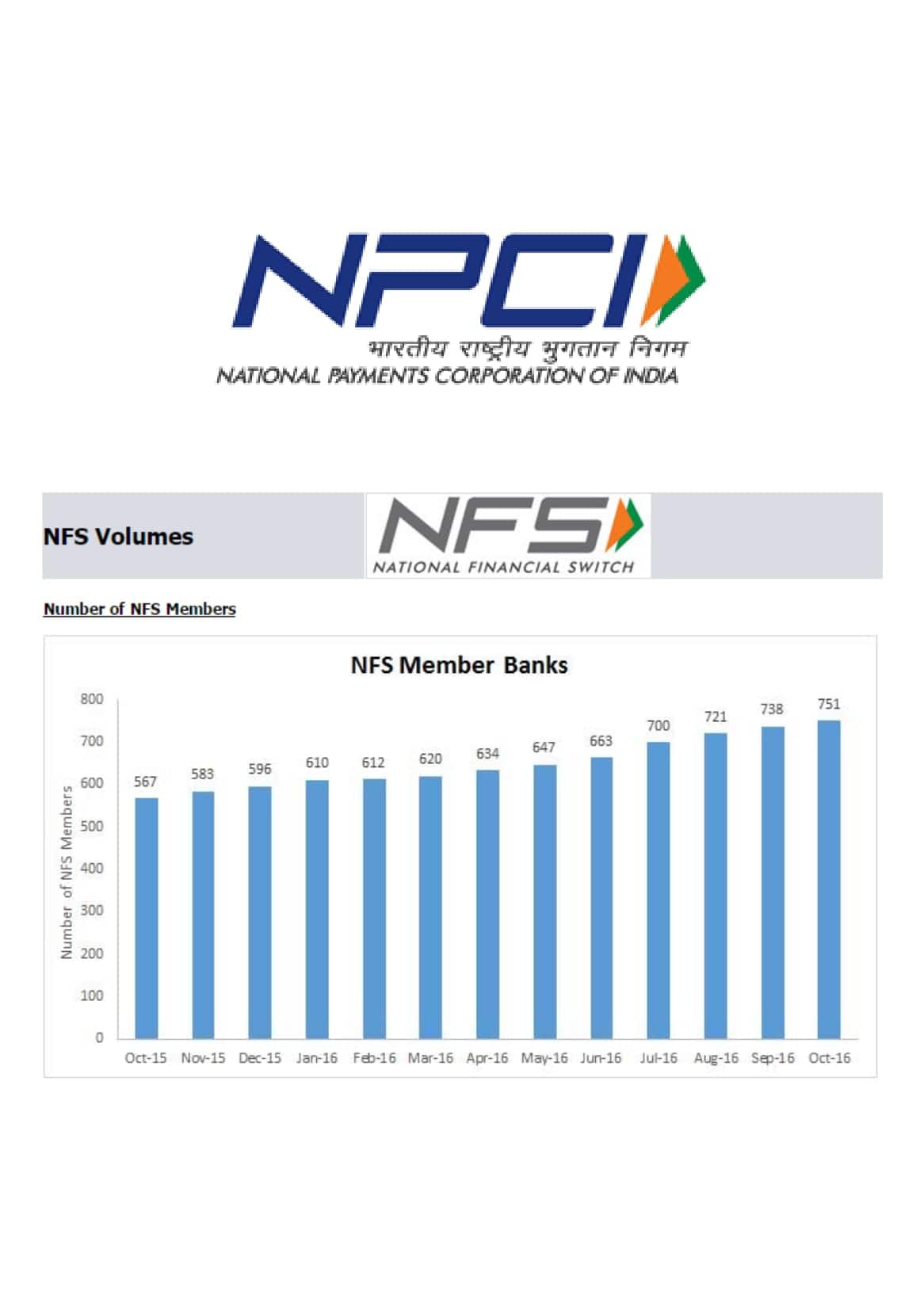

National Payments Corporation of India (NPCI) is pleased to announce that 100 banks have joined the National Financial Switch (NFS) network as direct members.As on December 07, 2016, NFS network comprise of 745 members which include 100 direct members, 645 sub-members including Regional Rural Banks (RRBs) and White Label ATM Operators (WLAOs). The network has now 2,30,000 ATMs.

NFS is the largest interoperable ATM network in India. It manages more than 95% of the domestic interbank ATM transactions.

A P Hota, MD & CEO, NPCI said, “NFS has emerged as one of the well-established ATM networks in the world. Its operational functions and services are at par with most of the global ATM networks. NFS has maintained high standards of application and network uptime which has helped our member banks to ensure enhanced customer experiences.”

Apart from basic transactions like Cash Withdrawal and Balance Enquiry, other Value Added Services (VAS) offered at ATM sare:

- Interoperable Cash Deposit,

- PIN Change, Mini Statement,

- Mobile Banking Registration,

- Card-to-Card Fund Transfer,

- Cheque Book Request and Statement Request to its members.

These VAS transactions seamlessly address the need of customers, enhance convenience and also help the bank to leverage its ATM network.

Direct Member: Direct members are those banks that directly participate in clearing and settlement with NPCI. Direct member bank can also act as a sponsor bank.

Sub Member: Sub member banks are sponsored by the direct member banks

NPCI’s National Financial Switch Achieves Milestone